A fair tax system is one where everyone pays their share — no more, no less. But in San Antonio, that’s not the reality for many families. Urban3’s assessment equity analysis reveals a troubling pattern: the lowest-value homes are often over assessed, while higher-value homes tend to be under assessed.

This means that many low- and middle-income families are effectively overpaying on their property taxes, while wealthier homeowners benefit from undervaluation. In 2023 alone, homeowners in the lowest deciles of property values overpaid by $41 million in taxes. Meanwhile, homeowners in higher-value properties saved over $550 million. This imbalance distorts the tax system and places an undue burden on those least able to afford it.

- Montenegro & Jankowski

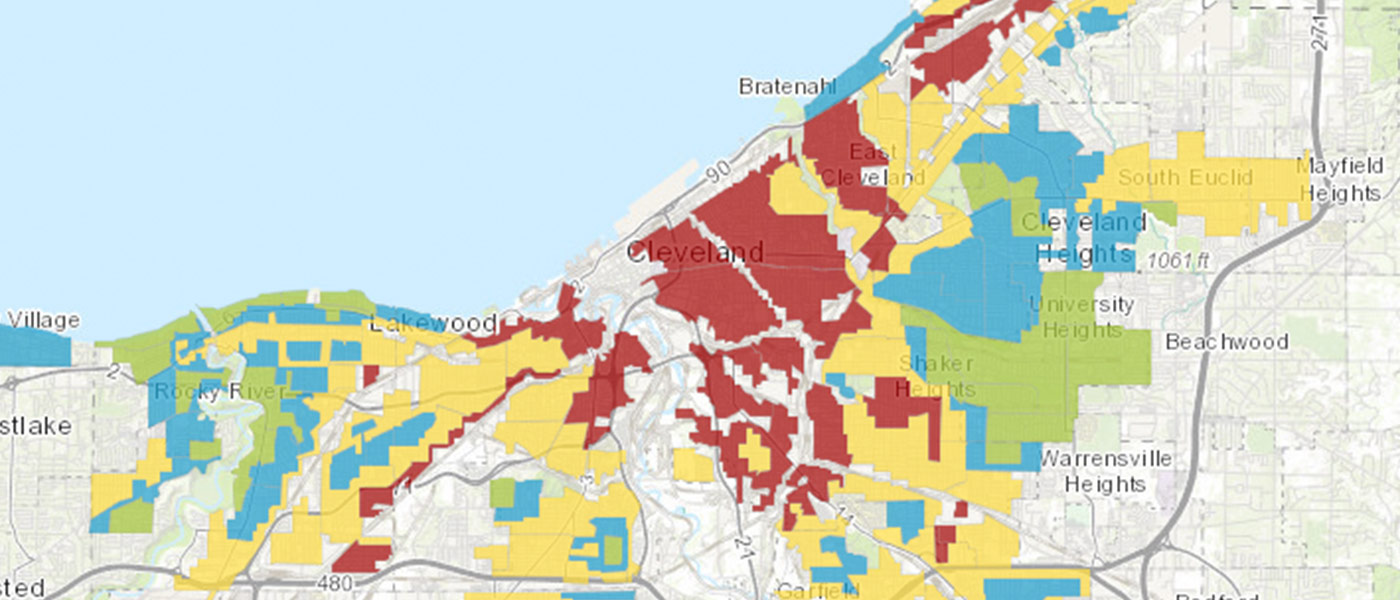

These inequities are not new — they reflect the legacy of redlining and systemic disinvestment. Neighborhoods like San Antonio’s South Side, which were redlined in the 1930s and deemed “hazardous” for lending, continue to show lower property values and higher rates of over assessment. In contrast, areas like Alamo Heights — historically considered desirable and predominantly white — are more likely to be under assessed.

Showing disparities between communities of lower incomes

This is more than a financial problem. It’s a matter of justice. A tax system that penalizes the poor and rewards the wealthy reinforces historic inequities and undermines public trust. It also starves underinvested neighborhoods of the resources they need to thrive.

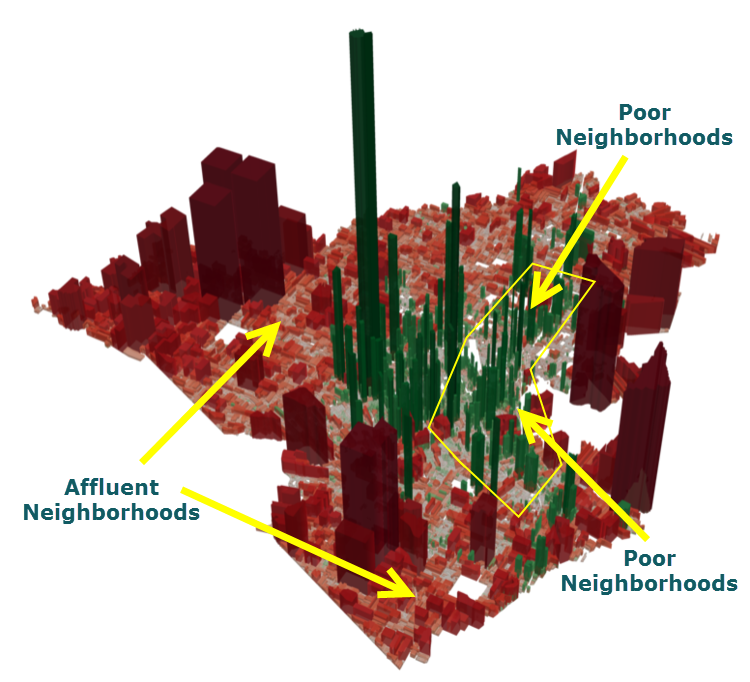

Contrary to common assumptions, the neighborhoods society often overlooks are the ones with the greatest potential. In Poor Neighborhoods Make the Best Investment, Charles Marohn explains how disinvested areas offer the highest return for cities willing to make small, incremental investments. With existing infrastructure, walkable design, and undervalued properties, these communities can deliver big gains — not just financially, but socially and culturally too.

- Strong Towns

Fixing this won’t happen overnight. But recognizing the issue is the first step. Transparent, data-informed assessment practices and targeted investment in historically disadvantaged neighborhoods can begin to close the gap. Fairness isn’t just about tax bills — it’s about ensuring every neighborhood has the opportunity to succeed.

Sprawl might look cheap on the surface — but San Antonio is paying the price.