A city’s financial health depends on its ability to generate revenue while efficiently managing costs. San Antonio’s economic future is tied to its tax structure, infrastructure spending, and land use policies. Understanding these financial mechanisms is key to making data-driven decisions that support long-term sustainability.

Dolor fugiat laborum quis incididunt laborum occaecat occaecat id velit id aliqua culpa. Exercitation ut anim commodo voluptate qui duis proident dolore nostrud nostrud cillum. Irure commodo qui excepteur reprehenderit adipisicing et eu voluptate nisi aliqua qui anim id anim exercitation. Dolore veniam nulla tempor enim velit consequat adipisicing consectetur sint duis nisi consectetur mollit irure. Qui sint amet cupidatat commodo pariatur sint duis exercitation ullamco. Aute ad duis deserunt tempor. Incididunt consequat nostrud aliquip tempor nisi proident ullamco laboris sunt ex elit occaecat reprehenderit adipisicing.

Dolor fugiat laborum quis incididunt laborum occaecat occaecat id velit id aliqua culpa. Exercitation ut anim commodo voluptate qui duis proident dolore nostrud nostrud cillum. Irure commodo qui excepteur reprehenderit adipisicing et eu voluptate nisi aliqua qui anim id anim exercitation. Dolore veniam nulla tempor enim velit consequat adipisicing consectetur sint duis nisi consectetur mollit irure. Qui sint amet cupidatat commodo pariatur sint duis exercitation ullamco. Aute ad duis deserunt tempor. Incididunt consequat nostrud aliquip tempor nisi proident ullamco laboris sunt ex elit occaecat reprehenderit adipisicing.

Dolor fugiat laborum quis incididunt laborum occaecat occaecat id velit id aliqua culpa. Exercitation ut anim commodo voluptate qui duis proident dolore nostrud nostrud cillum. Irure commodo qui excepteur reprehenderit adipisicing et eu voluptate nisi aliqua qui anim id anim exercitation. Dolore veniam nulla tempor enim velit consequat adipisicing consectetur sint duis nisi consectetur mollit irure. Qui sint amet cupidatat commodo pariatur sint duis exercitation ullamco. Aute ad duis deserunt tempor. Incididunt consequat nostrud aliquip tempor nisi proident ullamco laboris sunt ex elit occaecat reprehenderit adipisicing.

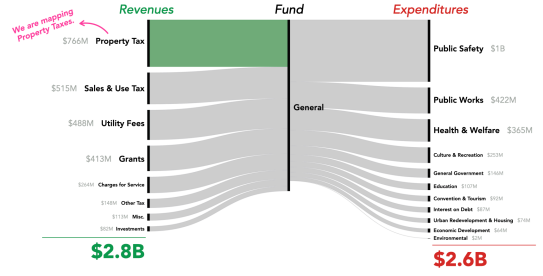

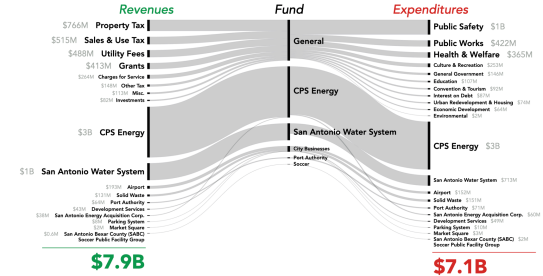

Comparing Revenue & Costs: By analyzing where tax revenue is generated versus where city funds are spent, decision-makers can identify inefficiencies and adjust spending to maximize financial returns.

By leveraging financial data, revenue mapping, and strategic planning, San Antonio can ensure a stable, equitable, and financially sound future for all residents.

- Joe Minicozzi

Not all land is created equal when it comes to tax revenue generation. The way land is developed and utilized directly impacts San Antonio’s fiscal health. A deeper understanding of property productivity can help guide policy decisions that maximize value while minimizing costs.

By focusing on value per acre as a core metric, San Antonio can make land use decisions that strengthen its tax base, reduce infrastructure costs, and create a more vibrant and sustainable city.

A fair tax system is one where everyone pays their share — no more, no less. But in San Antonio, that’s not the reality for many families. Urban3’s assessment equity analysis reveals a troubling pattern: the lowest-value homes are often over assessed, while higher-value homes tend to be under assessed.