San Antonio’s land is not equally productive — and that has big consequences for the city’s financial health. Urban3’s analysis flips the script on how we typically measure value. Instead of simply looking at the total tax revenue from a property, they ask: how much value is produced per acre of land? When you consider land as a finite resource, this question becomes crucial. Just like we wouldn’t judge a car by how far it can go on one tank without knowing the size of the tank, we shouldn’t judge development by its total value without considering how much space it consumes.

The findings are striking. While sprawling developments may seem impressive in total value, they often deliver far less revenue per acre than more compact, walkable forms of development. In downtown San Antonio, some properties generate over $10 million in taxable value per acre. Compare that to car-oriented commercial developments with expansive parking lots, which might barely surpass $1 million per acre. It’s a massive difference in productivity — and one that has significant budgetary implications.

Residential development tells a similar story. Single-family homes across San Antonio average about $1 million in value per acre. But “missing middle” housing — duplexes, townhouses, and small apartment buildings — averages $1.4 million per acre. Multifamily housing is even more efficient, producing $2.4 million per acre on average. These forms of development deliver more tax value with less land, while also supporting greater housing diversity and affordability.

This data helps clarify what kinds of growth are sustainable. Density isn’t a buzzword — it’s a strategy for fiscal health. Communities that concentrate development in walkable, mixed-use areas generate more value for each dollar spent on infrastructure and services. They pay back more and cost less.

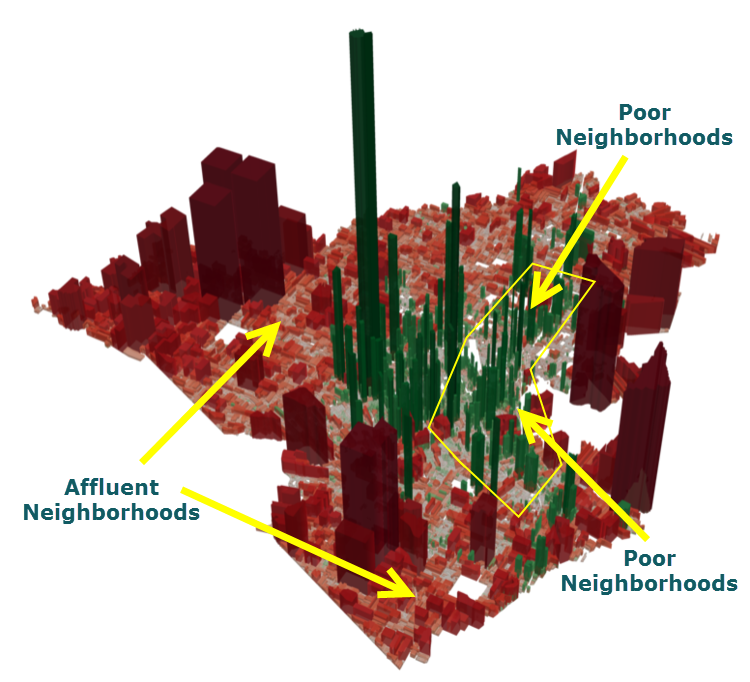

Urban3’s maps and models make these patterns clear and visual. The areas with the highest productivity — often historic neighborhoods, mixed-use corridors, and downtown blocks — stand in sharp contrast to large parcels on the outskirts of the city. If we want a financially resilient San Antonio, we need to build the kinds of places that actually pay for themselves.

A fair tax system is one where everyone pays their share — no more, no less. But in San Antonio, that’s not the reality for many families. Urban3’s assessment equity analysis reveals a troubling pattern: the lowest-value homes are often over assessed, while higher-value homes tend to be under assessed.